Final Expenses

Secure final expenses to provide financial support during challenging times. Find peace of mind, knowing that this coverage will help cover funeral costs, outstanding debts, and other essential expenses for you or your loved ones.

Final Expenses Insurance

Final Expenses

Secure final expenses to provide financial support during challenging times. Find peace of mind, knowing that this coverage will help cover funeral costs, outstanding debts, and other essential expenses for you or your loved ones.

Funeral Expense Coverage - Financial support for funeral expenses.

Debt Settlement Insurance - Assistance in settling outstanding debts.

Final Expenses Protection - Coverage for essential end-of-life expenses.

Family Support Benefit - Financial support for your loved ones during difficult times.

Coverage highlights are shown above; for full details on coverages and exclusions, kindly view the policy wordings.

Why get Final Expenses Insurance?

What is final expenses insurance, and why do I need it?

Final expenses insurance is a financial product that provides a lump sum payment to your beneficiaries to cover end-of-life expenses, including funeral costs and outstanding debts. It serves as a financial safety net, offering protection and support to your loved ones during challenging times.

How does final expenses insurance differ from other types of life insurance?

Final expenses insurance is specifically designed to cover the costs associated with funerals, outstanding debts, and other end-of-life expenses. Unlike traditional life insurance, which may provide broader coverage, final expenses insurance focuses on the specific needs associated with your passing.

How much final expenses insurance coverage do I need?

The amount of coverage you need depends on factors such as funeral costs, outstanding debts, and other anticipated expenses. A good practice is to estimate the total financial needs associated with your final expenses and select coverage accordingly.

Can I change my final expenses insurance coverage over time?

Yes, most final expenses insurance policies offer flexibility. You can typically adjust your coverage amount or review your beneficiaries. It's essential to discuss any changes with your insurance provider to ensure your coverage aligns with your evolving needs.

How are final expenses insurance premiums determined?

Premiums are influenced by factors such as your age, health, coverage amount, and type of policy. Securing final expenses insurance early may result in more favorable premiums. It's advisable to lock in a policy early to ensure financial protection during challenging times.

What is a beneficiary, and how do I choose one?

A beneficiary is the person or entity who receives the death benefit if you pass away. You can choose one or multiple beneficiaries, and they can be family members, friends, or even charitable organizations. Regularly review and update your beneficiaries to reflect changes in your life circumstances.

Is there a waiting period before my final expenses insurance coverage takes effect?

In most cases, final expenses insurance coverage takes effect immediately upon approval and payment of the first premium. However, it's essential to carefully review the terms of your policy, as certain situations or policy types may have specific waiting periods.

Where do I see coverage details and exclusions?

Please refer to the policy wordings for the full list of benefits, exclusions, and limitations. You can also contact our licensed agents at support@smartbunny.com if you have any additional questions.

Can I borrow against the cash value of a final expenses insurance policy?

Final expenses insurance policies may not accumulate cash value in the same way as whole life policies. Therefore, borrowing against the cash value may not be applicable. It's recommended to consult with your insurance advisor for specific details about your policy.

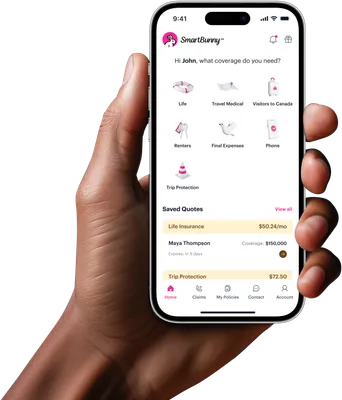

Get SmartBunny

✔️ Download the App

✔️ Sign Up and Explore

✔️ Get a Quote and Get Covered

What Policyholders Say

With happy customers across Canada and the United States, we pride ourselves with the feedback we get from our members.

4.8

749 Ratings

4.8

AppStore

1.4k Ratings

4.4

66 Ratings

It was so affordable and easy to get life insurance. Although the coverage amount is not big, it’s really just the cost of a few cups of coffee.

Wenzhen

Email review

Quick, easy, cheap, convenient. Couldn’t ask for more.

Pauline

App Store Review

During this trying time, the level of service is simply amazing. I have never seen any insurer that takes ownership and sees things through like SmartBunny!

Peter

Facebook review

SmartBunny had the best price and the best policy I could find for travel insurance. I'm only using SmartBunny from now on!

Bryan

Google review

Lots of companies claim an easy sign-up, instant life insurance and the lowest prices. But so far none offer as low a price as SmartBunny.

Dorothy

Email review

In my multiple decades on this planet, I cannot ever think when I bought insurance and said 'that was painless, quick, and kinda a fun experience.'

Brent

App Store review

Easy to use, completely inexpensive and peace of mind! Love it. I’ll never 'fly' with anyone else ever again!

Patti

Facebook review

Impressive and simple app design. Easy to follow, and got my travel insurance in 2 mins! Thank you.

Aarjav

App Store review

The App was amazing, and thought the premium was more than fair. No printed documents, etc.

Agata

Google review

I was happy to find SmartBunny for my critical illness insurance. Everything they were offering (price, coverage, and terms) seemed perfect for me.

Jason

Email review

The quote process was fast and very user friendly. The price is on par or better than a couple other companies I got quotes from.

Lorien

App Store review

I went with SmartBunny after watching their ad on TV, since the rate for the same coverage elsewhere is at least $50.00 higher.

Gordon

Email review